75 DAVIS ST

{{ percent(capRate, 1) }}

{{ percent(CoC, 1) }}

{{ percent(onePercentRule, 1) }} IRR

{{ percent(idealIRR, 1) }}

{{ currency(unitsTotalRentalRate, 0, '-') }} {{ currency(calcParams.strRentalRate, 0, '-') }} {{ currency(monthlyRental, 0, '-') }}

Total Monthly Rent Avg. Nightly Rate Rental Rate{{ currency(propertyValue, 0, '-') }}

Property Value{{ currency(calcParams.purchaseprice, 0, '-') }}

Purchase Price{{ currency(flipTotalCashInvested) }} {{ currency(calculatedResults?.existingInvestmentSummary?.investmentBasis.total) }} {{ currency(initialInvestment) }}

Cash Required Initial Investment Initial InvestmentCash on Cash (CoC) Return is the amount of cash flow you receive in one year compared to the amount of cash invested.

Your Cash on Cash gauge reflects a goal of {{ percent(blueChipCriteria?.minCoC) }}. You can adjust your CoC goal in Settings - Blue Chip Criteria.

The formula for Cash on Cash Return is:

Using the value from the analysis on this page, the CoC Return is calculated as follows:

Continue to learn more!:

Rescover Investment Term Library

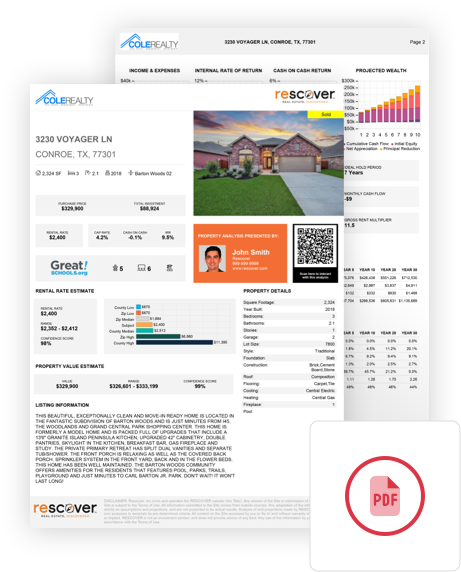

Internal Rate of Return (IRR) measures how much, on average, you earn annually from a property—factoring in both the amount of money you invest and when you get money back (like rental income or sale proceeds).

Your IRR gauge reflects an IRR goal of {{ percent(blueChipCriteria?.minIRR) }}. You can adjust your IRR goal in Settings - Blue Chip Criteria.

While cap rate and cash on cash measure the value and performance of a property annually, IRR takes into consideration appreciation, amortization, and the time value of money.

Because earlier cash flow is "worth more" in IRR terms, a faster exit can increase IRR even if you end up with less total profit. That's why it's helpful to look at both IRR and total wealth accumulation when deciding how long to hold the property.

The formula for IRR is quite complex. It is not something you would ordinarily calculator without a financial calculator or spreadsheet.

To setup an IRR calculation, you need to know your initial investment, the cash flows received each year during the investment, and the sales proceeds at disposition. This information is placed in a t-bar chart, in the format below:

| Period | Cash Flow | + | Sales Proceeds |

|---|---|---|---|

| 0 | (Initial Investment) | ||

| 1 | CF 1 | ||

| CF x | |||

| 7 | CF 7 | + | Sales Proceeds |

A t-bar chart populated with the values from the property analysis on this page looks as follows:

| EoY | Cash Flows | Sale Proceeds |

|---|---|---|

| {{ getIrrYear(idx) }} | {{ currency(value, false) }} | {{ currency(getHoldNetEquity(idx), false, '') }} |

IRR = {{ percent(getHoldIrr, 1) }}

Adjust the hold period below to see how it affects the IRR

Continue to learn more!:

Rescover Investment Term Library

- Tenant Occupied

- {{ propertyStore?.property?.mlsSource?.status }}

{{ currency(calculatedResults?.existingInvestmentSummary?.investmentBasis.total, 0, '-') }} {{ currency(initialInvestment, 0, '-') }}

Initial InvestmentInitial Investment is the total amount of money you put in upfront to purchase and prepare the property—like your down payment, closing costs, and any immediate repairs or improvements. This figure helps you see how much of your own cash is tied up before rental income (or other revenue) starts coming in.

The initial investment for the property on this page is summarized in the table below:

{{ currency(netEquity) }}

Current EquityPlease review and edit this property's Financial History to continue.

Offcanvas with body scrolling