6 HILLSIDE FARMS DR

0.0%

-

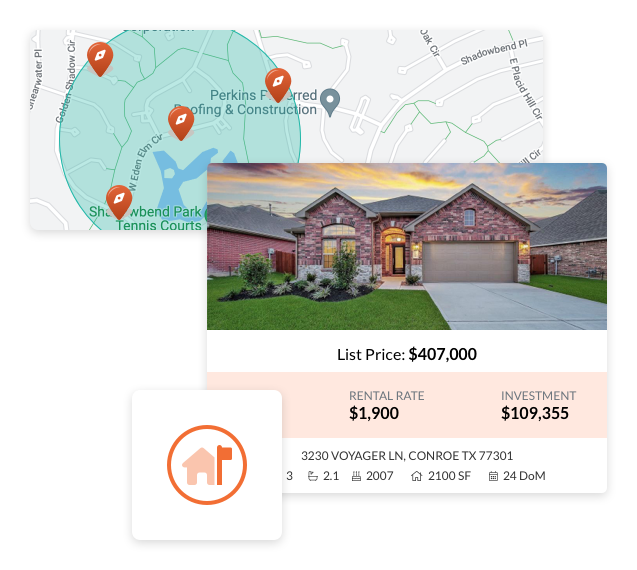

Rental Rate$0

Purchase Price-

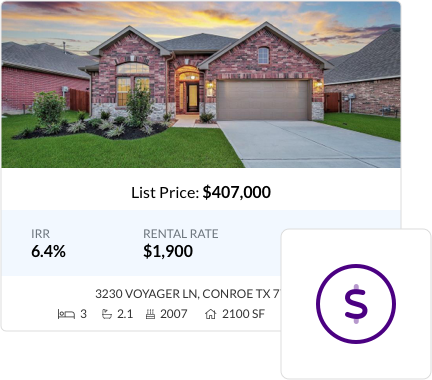

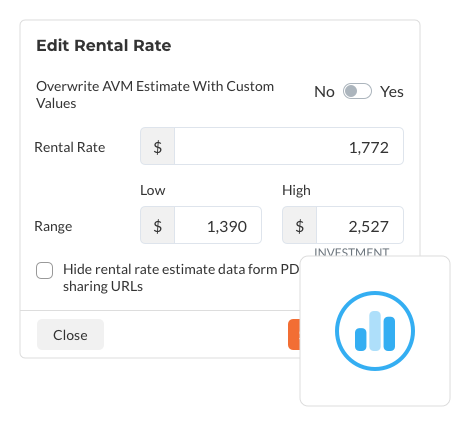

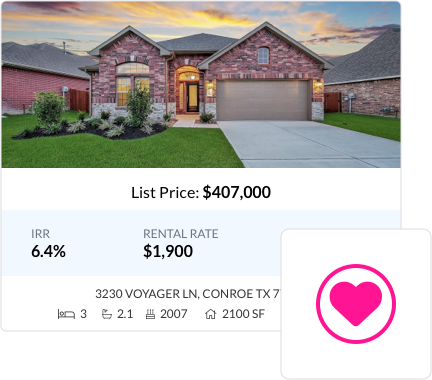

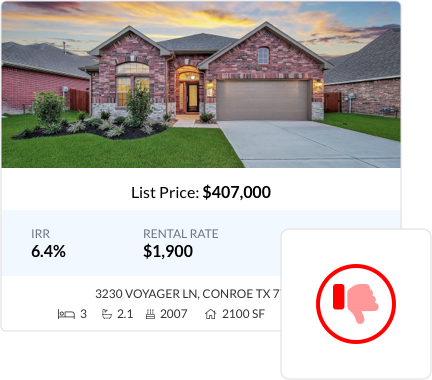

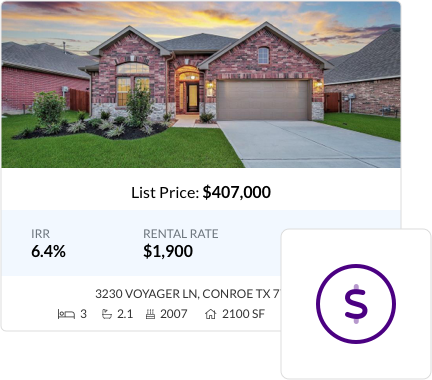

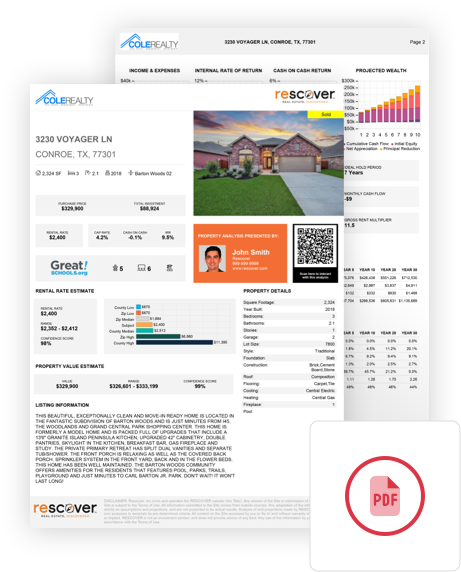

Total InvestmentAutomated Valuation Modeling (AVM) uses machine learning algorithms to predict the rental rate for the subject property. These values are updated as often as monthly, based on closed transactions of similar properties in the area. Adjustments to the rental rate in the Rescover calculator will not affect the figures displayed on this card.

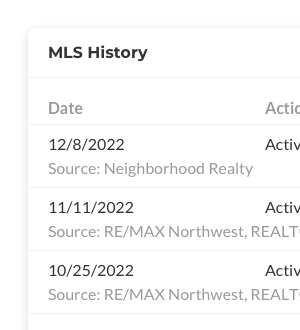

With an account you can view MLS price history.

Activate MLS History!

Calculating

Calculating

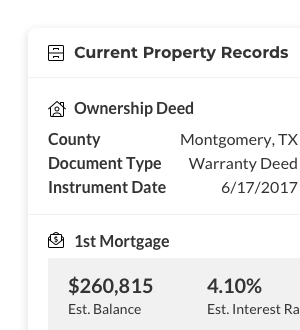

| Purchase Price | |

| Plus: Title Charges | |

| Plus: Rehab Expense | $0 |

| Total Cost | $0 |

|---|---|

| Less: Loan Amount | () |

| Plus: Loan Fees | |

| Plus: Working Capital | $0 |

| Total Investment | - |

Create an account

to view KPIs!

Calculating

| Mortgage Payment (P&I) | |

| Property Tax | |

| Property Insurance | |

| Total Monthly Costs |

|---|

Calculating

| INCOME | |

|---|---|

| Potential Rental Income | |

| Vacancy Loss | |

| Effective Income | |

| OPERATING EXPENSES | |

| Property Tax | |

| Property Insurance | |

| HOA | |

| Property Management | |

| Leasing Commissions | |

| Property Maintenance | |

| Utility Expenses | |

| Other Expenses | |

| Total Expenses | |

| Net Operating Income | |

| NON OPERATING EXPENSES | |

| Monthly Debt Service | |

| Capital Expenditures | |

| Total Non Operating Expenses | |

| Total Cash Flow | |

Calculating

| Property Value The property value displayed in this table shows the expected appreciation you will realize over the next 30 years. |

|---|

| Rental Rate The rental rate displayed in this table shows the expected future rental rates you will achieve over the next 30 years. |

| Monthly Cash Flow Monthly cash flow is the average amount expected to receive each month after operating expenses and debt service are paid. |

| Gross Wealth Accumulation Gross Wealth Accumulation is the amount you would expect to receive at the end of each year, including cumulative cash flow, and the gross proceeds at the sale of the home. |

| Net Gain on Investment |

Calculating

| Effective Income |

|---|

| Operating Expenses |

| Net Operating Income |

| Non Operating Expenses |

| Annual Cash Flow |

View our full 30 year analysis

with an account!

Calculating

| Property Value |

|---|

| Loan Balance |

| Cost of Sale |

| Net Equity |

School Information

School Information

View detailed school information

with an account!

Learn more about school information

Offcanvas with body scrolling